free cash flow yield plus growth

Going forward there is no way to be sure that free cash flow yield will continue to provide the best returns. The terminal value of the firm is TVA1 1-d where d is the rate of depreciation.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Other familiar names include stocks such as Fortinet and Etsy.

. Is the poster child for free cash flow yields. To simplify if a stock could have a 5 dividend yield and a 5 growth rate while. Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio.

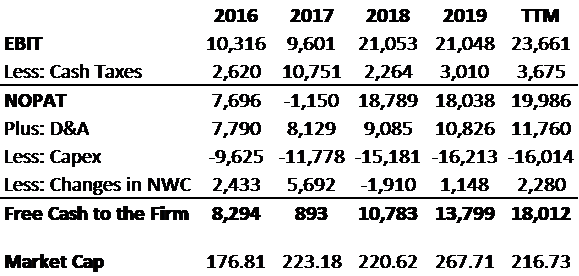

Assuming an inflation rate of 25 the forward rate of return on an investment in the SP 500 is about 65 today 25 free cash flow yield plus 15 real growth plus 25 inflation. Growth in free cash flow generation for each of the past 5 years. Free Cash Flow from Operations 37914.

Thats because Humanas cash balance is so large that the companys enterprise value. In any event doing some extremely rough math we can derive free cash flow per share in 2023. It had capex spending of 136 million which means CVR generates 611 million in free cash flow.

The ratio is calculated by taking. Sales Growth next year 10. Free Cash Flow Yield 786.

Divided by the stock price so thats your free cash flow yield plus the annual rate of growth in that cash flow while still making such payments. In fact there have been market cycles where companies with high free cash flow yields have. The firms level of assets in the second period is given by A1I0 A0 1-d and the.

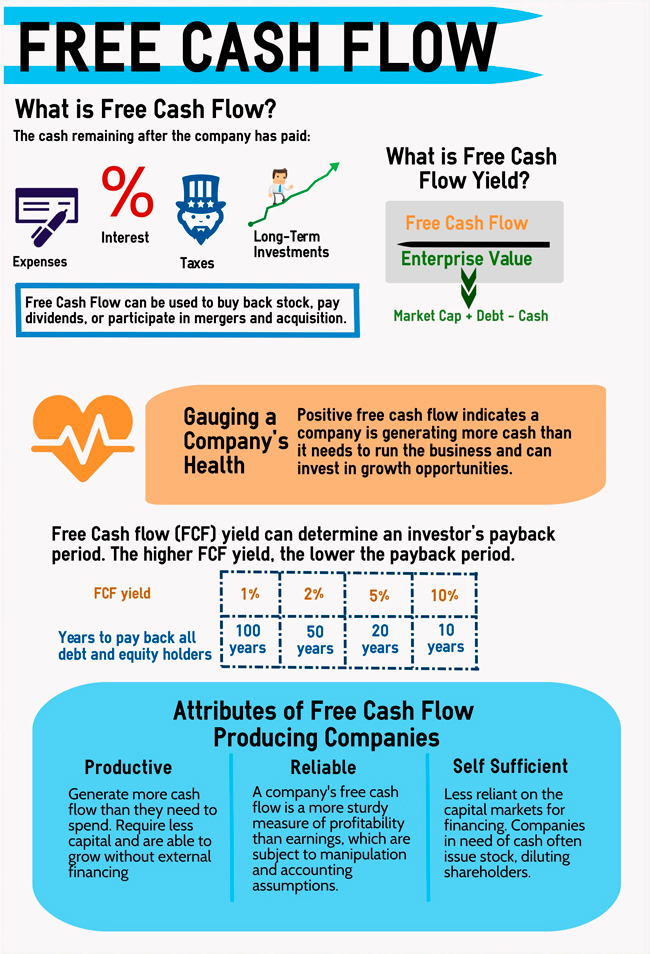

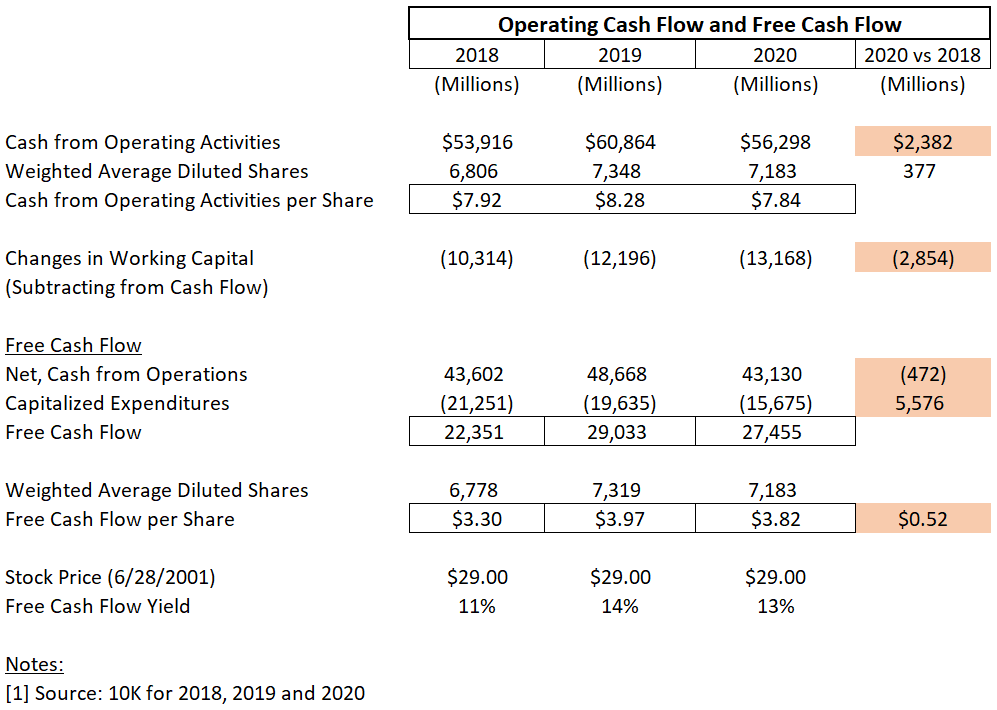

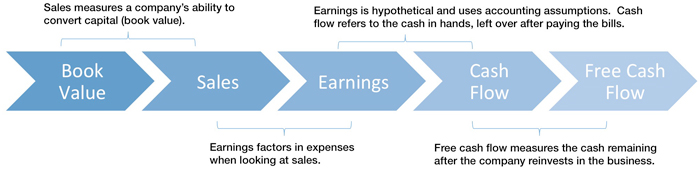

To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. The number that really matters isnt free cash flow. Free Cash Flow Yield 16932 Billion 21516 Billion.

Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns. Free cash flow yield is really just the companys free cash flow divided by its market value. Pfizers dividend yields an above-average 29 at current share prices and the company hiked its quarterly payouts.

As of March 11 the markets free cash flow yield is about 54. For the growth part of the Forward Rate of Return calculation GuruFocus uses the 5-year average growth rate of EBITDA per share as the growth rate and the. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn against its market.

Free Cash Flow Yield Plus Growth Alphabet annual free cash flow for 2019 was 30972b a 3565 increase from 2018. PPE 16104 Free Cash Flow 37914 16104. But over the past four quarters its free cash flow surged to 292 billion.

The firms free cash flow in the initial period is given by FCF0 ROA0A0 I0-C0 where C0 represents the costs and frictions associated with deploying the investment. Then the free cash flow value is divided by the companys value or market cap. People sometimes describe this as free cash flow yield cash on cash yield is a different measurement often used to evaluate real estate investments.

Weve been told that T ought to be pulling. We could also look at the free cash flow yield in relation to its trailing-twelve-month numbers or TTM to get the latest yield. Free cash flow is the cash left over after a company has paid expenses interest taxes and long-term investments.

Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. In depth view into Canopy Growth Free Cash Flow Yield including historical data from 2014 charts stats and industry comps. In depth view into Flora Growth Free Cash Flow Yield including historical data from 2021 charts stats and industry comps.

There are some blue-chip names in the list such as Adobe and NVIDIA which are the two largest cap stocks in the list. In the 12 months ending September CVR Energy produced Cash Flow from Operations of 747 million. Free cash flow yield plus growth.

Its the amount of cash flow available to buy back stock pay dividends acquire other businesses etc. Assuming 80 debt finance at the same rates and consistent rental yields over the course of 10 years. It is used to buy back.

Free Cash Flow Yield.

The Power Of Free Cash Flow Yield Pacer Etfs

Free Cash Flow Yield Explained

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

At T Stock Don T Use Ebitda Look At Free Cash Flow Yield Nyse T Seeking Alpha

Fcf Yield Unlevered Vs Levered Formula And Calculator

The Power Of Free Cash Flow Yield Pacer Etfs

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

The Power Of Free Cash Flow Yield Pacer Etfs

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Southwestern Energy Big Fcf And Bullish Technical Breakout Nyse Swn Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)